🔆IDO (Initial DEX Offering)

Invest in your funds' safety.

Article published on Medium on 1st November 2021.

Introduction - Why an IDO?

In this document, we describe the process SOY Finance will follow during its Initial Dex Offering (IDO). The process is designed to fulfill the demands of both small and large investors, while maximizing the involved participants’ trust.

The IDO will open on Wednesday, 03 November 2021 at 10:00 and close on 02 June 2022 at 23:59, or earlier in the event that all SOY tokens have been sold.

The maximum number of SOY tokens for sale is 90 million.

As stated in the monetary policy vision, IDO funds will be reclaimed by the insurance department to develop an innovative, distributed insurance platform that will operate within the SOY finance system. That product will offer insurance and security services through SOY DeFi services.

The funds will be used for further improvement of the ERC 223 standard. We strongly believe that we will set new security standards through this approach, and will improve security across the DeFi industry. Specifically, our innovative, decentralized insurance mechanism aims to bring new safety standards in the DeFi ecosystem.

In doing so, SOY will become the first platform to insure a user’s deposited funds in the event of loss due to software errors. Through this initiative, we aim to change the way DeFi projects operate, and to encourage other DeFi projects follow suit by offering distributed insurance and auditing services, all with a singular goal in mind: Minimizing user loss.

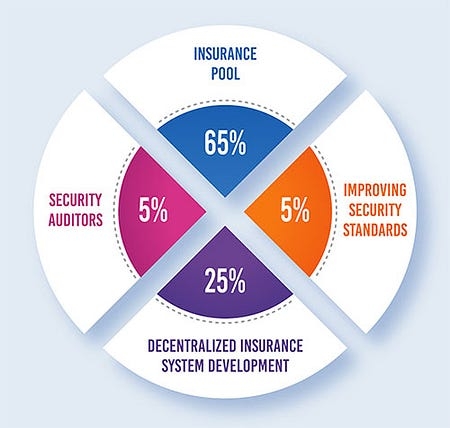

Funds raise in the IDO will be used based on the following priorities:

Create a pool to ensure that user losses are covered in case of a software error.

Development of a decentralized insurance system that will further increase the intrinsic value of the SOY token, which will bring additional benefits to users of SOY Finance, thereby increasing the platform’s overall safety.

Improving the ERC 223 standard, and promoting it to other DeFi projects.

Increasing the number of security auditors.

The received funds will be allocated as described in Figure 1.

SOY Finance Initial DEX Offering

SOY Finance will distribute 90 million SOY tokens during a seven-month process.

To ensure a fair distribution of the tokens, and to increase the platform’s decentralization, the SOY IDO will be performed in rounds of different duration.

Daily and weekly auctions will be held for the first six months.

Different amounts of tokens will be available for sale in both types of auctions, with smaller amounts available for the daily auctions, and larger amounts for the weekly auctions.

Specifically:

· 36 million tokens will be available for sale in the daily auctions.

· 24 million tokens will be distributed through the weekly auctions (960,000 SOY tokens per week). Also, the number of tokens for sale will increase with time.

At the end of this seven-month period, a final round will be held, with a total of 30 million tokens for sale at a fixed price.

Locking Period Duration

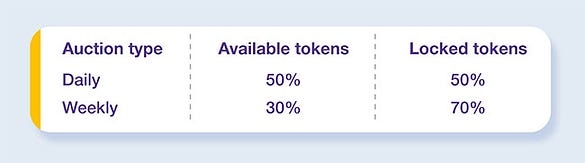

A portion of the tokens that are sold will be locked for a differing periods of time, depending on the auction type.

Daily auctions: 50% of the tokens acquired in the daily auctions will be available to the bidders at the end of the auction round. The remaining 50% will be locked for 12 months.

Weekly auctions*: 30% of the tokens will be available to bidders at the end of the auction. The remaining 70% will be locked for 12 months (Table 02).

Weekly auctions have been canceled because of the lack of sustained demand. More information about this decision can be found here.

Auction Process

The initial amount of SOY tokens for sale in the daily auction will be 30,000 SOY.

For the rounds following that, the total amount of tokens for sale will increase following by 72.336%, so that from the initial 30,000 SOY the number of tokens for sale will grow to 641,000 on the last day of the IDO process.

For the weekly auctions, 92,3076.92 SOY tokens will be available for sale each week.

The auction process will follow a modified Dutch auction in which we consider a minimum bid price and a maximum bid price. The exact price will be determined by the total amount offered by the bidders based on the following formula:

Min_price ≤ Total_deposits_by_bidders/ SOY_tokens_for_sale ≤ max price

When the auction ends, the tokens will be distributed to the investors, proportional to their deposited funds.

Based on the received bids the following cases may arise:

When the minimum criterion is met and the auction round ends, the auction process is considered a success for this round, and the SOY tokens are distributed to the users, proportional to their deposits.

When the offer is higher and the deposited funds match the maximum price defined by the price limits, the auction process stops before the time limit, since it has already succeeded. Tokens are again distributed to the bidders, proportional to their deposits.

When the required minimum price criterion is not met, and the time limit of the round ends, then the end of the round will be extended by one more period (day/week), with a maximum of three extensions (4 periods in total). In that case, a deadlock may occur, with the minimum price constraint never being met. The tokens will be sold at the end of the last (fourth) round, based on the offered bids, even if the minimum price criterion is not met.

In terms of calculating of the lower and upper limits, it will be performed based on the SOY price in the previous auction round. Each time, the minimum price will be set 10% lower, while the maximum price will be set 60% higher for the daily auctions, and 400% higher for the weekly auctions than the SOY auction price in the previous round.

If at the end of the aforementioned seven-month process, SOY tokens remain unsold, they will be burned, resulting in a decreasing maximum token supply.

Document revised on 28/12/2021.

Last updated