Monetary Policy Vision

Time to introducing fresh concepts into the DeFi space!

Article published on Medium on 1st September 2021.

Decentralized finance protocols – known simply as DeFi – have attracted wide interest in the last few years. The Total Value Locked (TVL) locked into DeFI smart contracts has exploded to more than $250 billion at the end of 2021, from roughly $620 million at the end of 2019, a 400-fold increase in just two years [1].

During the time, the number of active, DeFi wallet addresses has soared to more than 4.2 million from less than 100,000 [2], and well over 500 different DeFi applications now exist.

Though most users tend to think of DeFi as blockchain-based saving and lending, the reality is that DeFi refers to a much broader expanse of products and services aimed at savers, investors, borrowers, lenders, and traders. The term wraps in the digital assets themselves, as well as financial smart contracts, protocols, and decentralized applications (DApps).

These financial services and products built on these blockchain networks replicate financial services and products that exist in the physical world, but they do so in an open and transparent way, and without relying on intermediaries and centralized institutions. As such, DeFi protocols offer an Automated Market Maker (AMM) liquidity provision that legacy financial institutions can’t match.

With that as the backdrop, let’s look at SOY Finance, a DeFi system based on PancakeSwap [3].

Many parameters were considered during the design of a Monetary Policy built specifically for a decentralized financial system, and which affects user rewards and behavior. It’s crucial to carefully plan the issuance rate, and the incorporated supporting mechanisms, so that the policy avoids unintended consequences.

SOY Finance has its own native governance token called SOY, which can also be used as a medium of exchange. To that end, SOY tokens can:

Be staked or farmed.

Interact with the rest of the world through exchanges.

Used to purchase votes in the governance systems.

Because SOY Finance relies on the wide participation of users who provide liquidity and ensure stable operations, the Monetary Policy is designed to offer economic incentives that increase the users’ participation through rewards. That, in turn, increases the decentralization of the entire system – one of the primary strengths and desires of blockchain technology.

Furthermore, to adapt to different scenarios without needing to change the Monetary Policy, we propose a dynamic approach, which stands in contrast to the static approach followed by the majority of existing DeFi protocols.

The advantage of our dynamic approach is the protocol’s inherent ability to adapt to system utilization. Doing so provides the appropriate incentives to users through rewards, which ensures the system’s stability and longevity.

Tokens of the SOY Finance System

SOY tokens will be issued at genesis and offered to investors through an Initial Decentralized exchange Offering (IDO).

Tokens also will be distributed to different classes of users (Liquidity Providers, Farming, Staking) at a rate that varies with time. At the same time, a set of “burning mechanisms” will be implemented to decrease the total number of SOY tokens in circulation. The burn rate will depend on system utilization and will increase as utilization increases.

SOY Finance makes use of a set of different tokens that are designed to:

Reward users for providing liquidity (Liquidity Providing tokens — LP)

Offer staking/farming opportunities (SOY token).

Offer participation in the governance System (Voting Token — VT).

These tokens will be minted and burned as described below:

Liquidity Providing tokens will be used to distribute part of the trading fees to liquidity providers, based on their share of the total liquidity provided in a particular cryptocurrency trading pair. To accomplish this, a unique LP token is created for each of the available trading pairs. The user’s liquidity share is defined by the number of LP tokens that user possesses relative to all LP tokens in that specific pair.

Newly minted SOY tokens will be distributed over time to users who stake/farm their tokens, what’s known as “yield farming.” This is a passive-income strategy that refers to the staking or locking up of the users’ assets in a smart-contract-based liquidity pool. In doing so, the user earns additional tokens, almost like an interest payment on a bank savings account.

Staking/farming plays an important role in helping DeFi achieve stability and avoid the negative, extreme effect of an absence of liquidity and/or price manipulation.

SOY token, meanwhile, will offer governance rights to holders, meaning SOY token holders globally will, over time, be increasingly responsible for platform management.

To that end, a weighted voting mechanism will be implemented based on the lock-up period selected by the user. This serves to reinforce the voting power of long-term holders. Based on the duration of the lock-up period, a different number of Voting Tokens will be issued for the same amount of SOY tokens.

For example, SOY tokens locked up for 12 months will offer two times more VTs compared to the same number of tokens locked for 6 months. The aim of the weighted voting mechanism is to reward long-term users who trust SOY Finance by providing to them increased weight in deciding matters that are important to the platform, such as:

Upgrading the monetary policy.

Tokens listing/delisting requirements.

SOY token issuance rate.

Burning mechanisms to be implemented.

SOY Token Genesis and Total Supply

As previously mentioned, the proposed Monetary Policy is dynamic in nature.

An advantage of this approach is the increased stability, independent of network utilization. Specifically, when transaction amounts and volumes are low, incentives will be offered to users to hold their tokens by rewarding them through farming and active participation in the SOY system’s decisions.

Conversely, as the system’s adoption increases, meaning transactions and volume rise, the value of the tokens will be accelerated through deflation that comes from the burning mechanisms.

Forecasting the long-term needs of the network is difficult, thus reducing token rewards in a predefined, static manner can significantly impact the whole system.

To address this, the proposed Monetary Policy consists of two mechanisms that can lead to different inflation and deflation periods, based on the System Utilization at the time. The Monetary Policy, therefore, can adapt to a user’s / token holder’s needs each time, and ensure system stability in the long run. As the SOY Finance system evolves and reaches a steady state, the targeted token supply will be equal to 600 million tokens. To achieve this, two competing mechanisms are used:

One that issues new tokens,

and one that burns existing tokens.

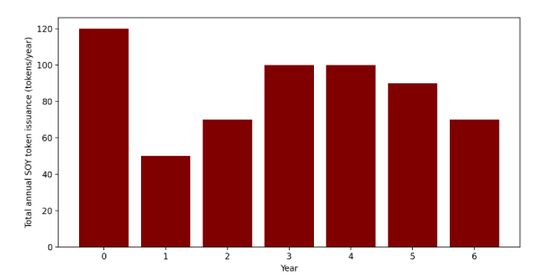

After genesis, SOY tokens are issued over time, and the issuance ratio varies as depicted in Figure 1.

The issuance ratio is divided into three different periods:

The adoption period: Newly minted tokens are not the highest ones, but because the number of users that take part in the adoption phase is limited compared to the next periods, the rewards will be significantly higher for early adopters.

Post-adoption: As widespread adoption starts, the total number of rewards will increase to support an even higher adoption rate.

Maturity: At this point, the number of generated SOY tokens decreases as time passes.

These choices are made with the goal of attracting the continuous interest of liquidity providers, and thus increasing the decentralization and democratization of the SOY financial system. The ultimate aim: To be the most decentralized DeFi system.

Burning Mechanisms

Rewards will be also offered to users who trust the system by providing them liquidity through the implementation of a set of token-burning mechanisms that will decrease inflation (or lead to deflation).

The burn rate of SOY tokens will depend both on the token price and the system’s utilization.

Consider these two examples to illustrate this point:

The ratio of produced tokens is higher than the burn ratio. Users have a financial incentive to farm their tokens.

The burn ratio is higher than the volume of produced tokens. The total number of SOY tokens in circulation decreases, thereby increasing the intrinsic value of the remaining SOY token.

At some point, stability is reached and the total number of coins in circulation will be steady and the targeted number of tokens in circulation will be equal to 600 million. This is the number that we will consider in our calculations as the maximum token supply.

After that point, the governance mechanism will play a central role in helping achieve stability, and decisions made through voting will determine changes in the system’s parameters (e.g., commission fee, burn rate, etc.).

Some of the token-burning mechanisms that will be implemented are as follows:

A burning mechanism that will receive a varying percentage of between 15%-30% of the total trading fee. On a weekly basis, SOY tokens will be rebought and burned.

The funds received through the Initial Farming Offerings (IFO) will be burned.

The number of burned tokens will depend both on the market price of SOY token and the transaction volume performed for trading/swaps, NFTs, and insurance services. As this volume increases relative to a specific SOY token price, the number of tokens will decrease at a rate that depends on the emission rate. In essence, a high burn ratio will lead to deflation periods. (At the end of this document, we perform projections for the expected inflation/deflation rate under different assumptions regarding the traded volume.)

Transactions Commission

For each trade/swap performed in the SOY Finance Network, a commission fee will be applied.

Phase 0 (few weeks) — The trading fee will be set to 0.2% of the volume of each transaction, and will decrease with time, as shown in Table 1.

Phase 1 — SOY Finance will use variable fees to audit newly listed tokens and increase the platform’s liquidity (a lower fee will be applied to larger trades). The trading fees will decrease with time.

Phase 2 — We expect the lowest fees at the start of this phase. For the tokens that have been audited by the Callisto Security Department, specifically, the trading fee will vary between 0.3% and 0.15%. For unaudited tokens, the fee will be between 0.5%-0.35%.

Initially, the received fee will be split among the liquidity providers (100%) and will decrease with time, declining to 55% in year 5 (Phase 2). Also, up to 15% of the fees will be split among SOY token holders, with 5% allocated to the insurance fund to ensure its operation over time. Finally, 20% will be repurchased as SOY tokens and will be burned at the end of pre-defined periods.

Initial DeFi Offering and Token Issuance

At genesis, 20% of the maximum supply of 600 million SOY tokens (in the stable case) will be created. The tokens will be distributed as follows (Figure 2):

75% will be distributed to early investors through an Initial Dex Offering. The received funds will be moved to the insurance system in order to increase the distributed insurance system liquidity at the early stage, and to increase the level of the security services offered.

10% will be airdropped in 7 consecutive phases, the details of each phase being announced at the time of its launch.

5% will be allocated to Callisto Enterprise.

5% will be allocated to Callisto team members via a dynamic motivation system that, over time, rewards team members for supporting the project’s development.

4% will be used for bug-bounty programs that help ensure high-security services, plus 1% of trading fees after year 1.

1% for marketing purposes, plus 1% of trading fees after year 1.

Different lock periods will be set for the different cases.

For Callisto Enterprise and the Core Team, the tokens will be locked for 5 years, with a fixed percentage released each month.

Governance System and Voting Weights

Another challenge that the proposed Monetary Policy targets is SOY governance.

Governance refers to the ways in which the system’s collective decisions are made, conflicts are resolved, and changes to the protocol are implemented. In DeFi, governance mediates activity between an application and the underlying settlement layer, including decisions such as altering interest rates or collateral requirements.

As such, SOY token will also act as a governance token transferring agency, responsibility, and control of the platform management from the team to the globally distributed and decentralized community of stakeholders who use the platform and engage with the SOY finance ecosystem.

By providing voting rights on certain governance decisions, the ultimate goal is to transform into a Decentralized Autonomous Organization (DAO), in which decisions are made by the community, organized around a specific set of rules.

Through Governance, users will control the system’s parameters to avoid extreme, unstable cases. The governance system will be fully available and working in Phase 2, projected to be year 5 (first-year decisions made by the team, and a 2-year transition period in which decisions are weighted 49% by the team, 51% by the community). Users will acquire voting rights by locking up SOY tokens for a predefined period. The lock-up period will determine the number of votes in a weighted voting system that gives long-term locks greater voting rights.

The voting rights will be assigned through Voting tokens distributed as follows:

Voting Tokens = (#SOY TOKENS) x (Lock up duration in quarters) x (lock-up period voting weight)

When SOY tokens are locked for a predefined period, users will receive rewards through farming and through Voting tokens, with the latter burned as the locking period ends. In figure 3, we present the voting weights with lock-up period duration for 1 SOY token.

Through the proposed voting weighted mechanism, the governance power is given to users who lock up their funds for longer periods and, thus, trust the SOY finance protocol at the highest level.

For example, users who lock up their tokens for 1 quarter receive 0.25 VT for each SOY token, while users who lock up their tokens for 4 quarters or more receive 1 VT for each SOY token. Note, that during this period, users receive the related farming rewards. With such an approach, the voting power between early investors and newcomers is balanced, and decisions are made collectively, considering the interest of all users, irrespective of when they invest in SOY.

Inflation Ratio and Total Volume Locked Projection

The system’s adoption and utilization through transaction volume define the size of the commission fees that will be distributed to liquidity providers or be burned.

A feature related to technology adoption, which is also validated in the historical data from existing DeFi protocols, is the so-called S-curve [4]. This S-shaped pattern is defined by slowly increasing volumes at the start, and then a sudden jump of activity as mass adoption unfolds. An example is presented in Figure 3 that depicts the increase in the TVL of all DeFi protocols with time. The S-shaped pattern is seen in each individual protocol such as Uniswap, PancakeSwap, and 1inch, according to their own data [1].

A sigmoid curve that follows the S-Shaped pattern can be defined as follows:

y = K./(1+exp(-G*(x-Dm)))

Where:

y is the uptake rate at time x.

Κ is the maximum value for the uptake.

G is the growth rate.

Dm is the time value of the horizontal axis at the sigmoid's midpoint that is when the curve reaches 50% of its supremum value.

In Figure 4, we plot the fitted function. The estimated values are:

K = 78200.2183

G= 0.45153

Dm = 42.3135.

Undoubtedly, the uptake of SOY tokens will vary as DeFi adoption grows over time. The adoption period will likely be faster than the uptake of the already existing systems. For this reason, we consider three different cases (Figure 5):

The worst-case, which corresponds to the uptake based on the historical data.

The average case shifted ahead by 12 months.

The best-case, shifted ahead by 24 months, and with the maximum TVL has been set to 170 million. The transaction volume is assumed to be equal to 10% of the TVL which is smaller than the current Uniswap ratio and is presented in the following figure.

Inflation and Burning Rate

As the TVL, and the amount and size of the transaction increases, the burn amount (in USD) also increases significantly. Based on our projections, the volume and the fees received by the different stakeholders at different years are presented in Table 3.

Note that inflation is incorporated into the system’s design to encourage liquidity providers and token holders to provide liquidity, which ensures the system’s long-term stability, and increases the total volume of transactions. An additional benefit is that more liquidity will result in smaller slippage tolerances when trading between cryptocurrency pairs.

Another parameter considered in DeFi is the Annual Percentage Rate (APR), which is an annualized representation of the users’ interest rate.

Based on the way SOY Finance operates, two different rewards are offered to users:

A part of transaction fees is offered to Liquidity Providers (LP_APR), while

New SOY tokens are distributed to the users who stake/farm their tokens (FARM_APR).

These two can act in unison to amplify returns for those who decide to both provide liquidity and farm their tokens. Therefore:

Total_APR = LP_APR+FARM_APR

The targeted Liquidity Providing APR for the different cases and for the next 4 years, varies between 7% and 15% and depends on the TVL and the volume of transactions performed through SOY.

Given different assumptions of the number of the staked/farmed tokens, the worst-case farming APR (assuming all SOY tokens are locked) is set at a minimum 5%. This is significantly higher for early adopters, roughly 20%.

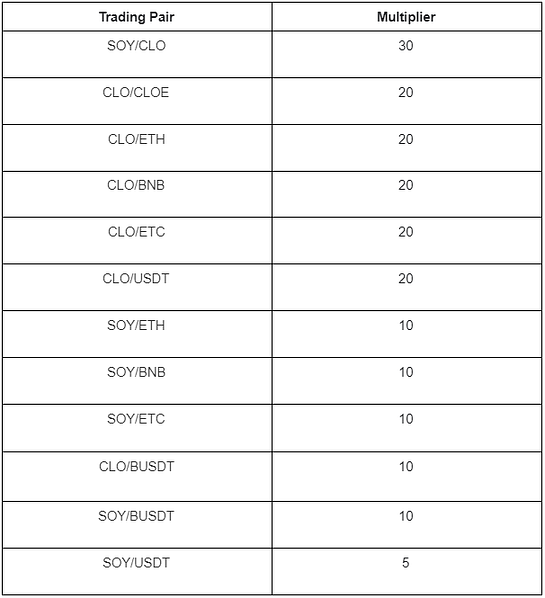

Also, multipliers are used for the different farms, which can affect the APR of a specific farm. The multiplier of a farm defines the amount of SOY tokens that are allocated to that specific farm in relation to the other farms. The calculation offers a weighted distribution of rewards to the different farms. In that case, the APR is affected by both the multiplier and the amount of LP tokens staked in the farm.

For example, if 100,000 SOY tokens are allocated to farms, then the farm with a multiplier of 40 would be getting most of the tokens since the multiplier is 40x. This does not mean that the APR, by way of multipliers, can be too high. A lot of users can stake their LP tokens in a particular farm, and in that case, the APR might be still low, despite the high multiplier.

The initial selection of multipliers is based on the expectation that the SOY/CLO pair will have the highest TVL and can also be used as an incentive for users to participate in farming. Also, CLO multipliers are higher compared to SOY multipliers, so as to offer incentives to CLO holders to participate in the SOY Finance ecosystem.

Document revised on 07/01/22.

References

[2] White paper Decentralized Finance: (DeFi) Policy-Maker Toolkit, June 2021.

Last updated