🌱Yield Farming

Liquidity Providers on SOY Finance can now earn extra passive income by farming their LP tokens .

Article published on Medium on 22nd October 2021.

Introduction

Soy Finance allows its users to trade cryptocurrencies directly, without the need for a third party.

As a decentralized platform that is based on an Automated Market Maker (AMM) protocol, SOY Swap’s design abandons the concept of an order book. Instead, users provide their funds to ensure liquidity. As an incentive, the liquidity providers are rewarded with a part of the transaction fees through “Liquidity Provider Tokens,” which in turn can be farmed to further increase the passive income.

Glossary:

Liquidity: It is the amount of a digital asset available on SOY Finance. The liquidity of an asset determines the ease with which a transaction can be completed without impacting the market price.

Liquidity pools: A smart contract providing liquidity between assets to facilitate transactions.

Liquidity provider: The investors who provide digital assets on SOY Finance. The digital assets provided by the users constitute the liquidity of the specific pool.

Yield Farming: It is a form of staking, investors can generate additional value by locking their Liquidity Provider Tokens to earn SOY Tokens.

Liquidity on SOY Finance

Liquidity represents the number of coins/tokens available on SOY Finance.

Investors “lend” their liquidity (coins/tokens) to a specific pool and receive Liquidity Provider Tokens (LP tokens) based on the time and amount of liquidity provided by that time from all the users.

The fees earned by the transactions are distributed among the liquidity providers based on their share of the pool’s liquidity. Hence, pools with higher volume of transactions earn more fees compared to pools with low transaction volume.

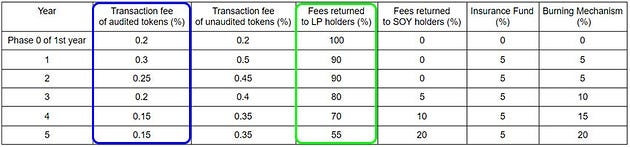

The table above shows the SOY Finance transaction fees (in blue) and their distribution (in green). The share allocated to liquidity providers varies over time, from 100% the first year to 55% after the fifth year.

For more details about the transaction fee allocation please refer to our Monetary Policy.

Yield Farming

Yield farming enables users to earn not only on the initial deposit but also on the rewards earned by providing liquidity and thus is a way to passively increase the received rewards

The mechanism of yield farming is very similar to the staking model: by locking LP tokens, investors earn SOY tokens.

How does it work?

Yield farming is a two-step procedure. Initially, to farm, you need LP tokens; each farm has its own LP tokens, so you will need “LP tokens” specific to the farm you want to join. For example, the SOY-CLO farm will only accept SOY-CLO LP tokens.

To obtain a specific LP token, you must provide liquidity for the corresponding trading pair. Thus, to get SOY-CLO LP tokens, you will first have to provide liquidity for the SOY-CLO pair.

In the second step, the received LP tokens need to be staked in order to earn SOY tokens.

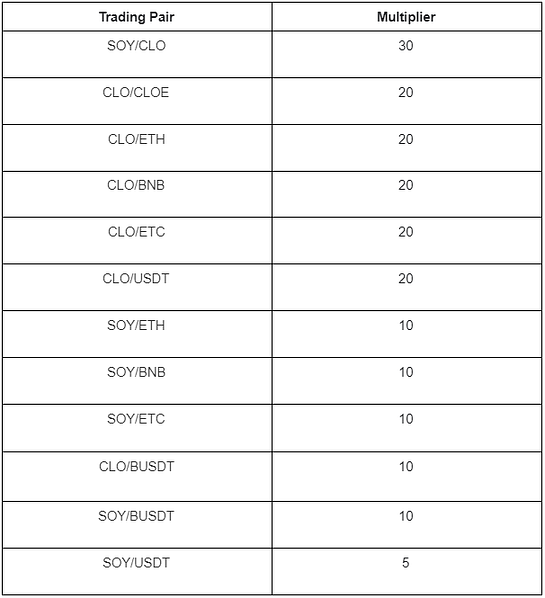

Different multipliers are used for the different farms, giving investors incentives to increase specific trading pairs’ liquidity or balance the rewards among the different pools based on the liquidity provided in each pool.

Below is a tab showing the initial multipliers selected.

Note: Multiplier is not the APR. It defines the number of SOY tokens allocated to a specific farm in relation to the other farms, the SOY tokens being distributed among the farm participants.

Please refer to our Monetary Policy for more details about the multiplier selection.

Last updated